If you are a 501(c)6 organization, you most likely:

- have members who pay the association membership dues.

- you are likely to participate in lobbying activities to better help the industry or trade your members are a part of.

If both of the above statements apply to your organization, this article is for you!

At this point you may be thinking, my (c)6 is allowed to lobby and incur lobbying expenses, so why does this matter? You are correct, 501(c)6 organizations are allowed to participate in lobbying and include it as part of their organization’s purpose without jeopardizing their exempt status. However, we care because of the Omnibus Budget Reconciliation Act of 1993 (OBRA 1993). Enacted by Congress, OBRA 1993 created notice and reporting requirements for associations that have lobbying expenditures.

Let’s walk through the requirements that are imposed:

Notice Requirement:

- 501(c) organizations may provide a notice to their members that contain the reasonable amount of dues paid that are allocable to lobbying, or

- If no notice is given, 501(c) org must pay a proxy tax on their lobbying expenditures.

- If notice is given, but the reasonable amount is underestimated, the org is subject to the proxy tax of the excess. Exception: the proxy tax can be waived if the org agrees to carry forward the excess and let members know on the following year’s notice.

Reporting Requirement:

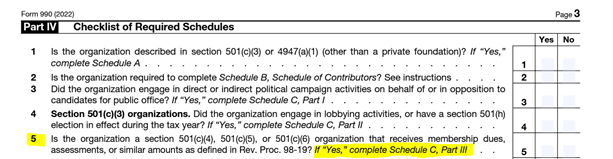

Form 990:

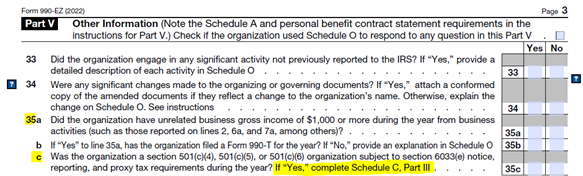

Form 990-EZ:

Both the 990 & 990-EZ take you to further reporting requirements on Schedule C, Part III if you mark “YES”:

![]()

Other items to note:

- Notice above that the 990 & 990-EZ questions that take you to Schedule C, Part III, are different. Make sure you read the instructions on how to answer those questions correctly.

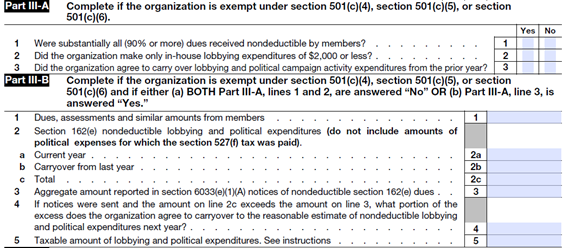

- Depending on how the organization can answer Schedule C, Part III-A, they may not be required to fill out Part III-B. Make sure you read the instructions on how to answer those questions correctly.

- If you decide to pay the Proxy Tax on lobbying expenditures instead of giving notice to your members, you do not need to send anything to them on the portion of their dues related to lobbying.

- The total amount to be taxed is calculated on Schedule C, Part III-B. It is then taken to Form 990-T, where the tax due is calculated and paid.

- If you do give notice to your members on the portion of their dues that are related to lobbying expenses, remember this is not a static amount. It can change year after year. Make sure you revisit this amount every year.

- Use Schedule C, Part III to help.

Adhering to the requirements of lobbying expenditures is crucial for 501(c)6 organizations to maintain compliance with their tax filings, and by being diligent in fulfilling these obligations, your association can continue serving its membership through its advocacy and lobbying efforts. If you are left with questions or looking for further clarification on notice and reporting requirements, check out 990 Schedule C: Lobbying for Associations. In this recorded webinar I dive deeper into these requirements, why it matters, and best practices for completing Schedule C.