“100% of your contribution directly supports our program.” Although it would be impressive to be able to make this claim as a charitable organization, it’s impossible.

The Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2016-14, Not-for-Profit Entities (Topic 958) – Presentation of Financial Statements of Not-for-Profit Entities to make improvements to the communication of information on not-for-profit financial statements, including functional expense reporting.

Functional Classifications

Functional expense classification is a method of grouping expenses according to the purpose for which the costs are incurred. The most common functional classifications, and the functional classifications seen on IRS Form 990, are program services, management and general, and fundraising.

So even though all the contributions your organization receives may support your overall mission, FASB has defined how some expenses get recorded functionally.

For an expense to be allocated to program services, the expense must be the result of direct conduct and/or direct supervision of a program service.

Any expense that has a benefit to the organization, as a whole, will automatically fall into the supporting activities function which includes management and general and fundraising.

Management and General Common Expenses

Some common expenses that are typically always management and general and are recorded in the management and general column on the Statement of Functional Expenses are:

- Support staff such as administration, human resources, and accounting

- Board expenses

- Legal fees

- Audit and accounting fees

- Billing and collecting fees relating to program services

- Administration of benefits

- Payroll processing fees

- Grant accounting and reporting – program reports would be program (directly grant related), but financial reports and related accounting would be management and general

Natural Classification

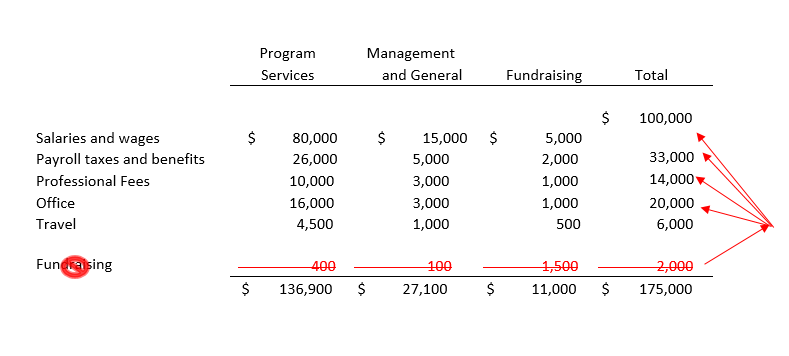

Additionally, expenses should be broken out by natural classification, which is a method of grouping expenses according to the kinds of economic benefits received. Natural classifications include expenses like salaries and wages, payroll taxes, employee benefits, professional fees, office expenses, and travel.

Fundraising related expense are recorded as a function (column) and are broken out by natural classifications (rows).

In the diagram, the proper way to account for $2,000 of fundraising related expenses would be to remove the fundraising row and redistribute the expenses to the rows identified by their natural classification.

For example, fundraising related expenses like printing and postage should be included in the office expense line, and staff time should be included in the salaries and wages line.

Keep these tips in mind as you’re recording expenses and you’ll be on your way to having an audit-ready Statement of Functional Expenses!